The Rise of the Contract Agent

October 07, 2025

Using AI Agents in Agricultural Commodities Trading:

The Rise of the Contract Agent

Introduction

Agricultural commodities trading — from grains and oilseeds to coffee, cotton, and sugar — thrives on precision, timing, and trust. Yet, the operational backbone of this market still leans heavily on manual contract management, fragmented credit reviews, and reactive compliance checks.

In an era where global trade volumes and market volatility are accelerating, AI Agents are emerging as intelligent partners that help traders, risk managers, and credit analysts move faster and smarter. Among these, none is more transformative than the Contract Agent — a specialized AI that reads, understands, and monitors trading contracts in real time.

The Contract Agent: A New Digital Partner for Contract and Credit Teams

What the Contract Agent Does

A Contract Agent is a domain-trained AI system that integrates with trading, risk, and back-office systems to act as the institutional memory of your contracts.

It’s designed to continuously read, reason, and alert — bridging the gap between static agreements and fast-moving market activity.

Core Capabilities

Contract Understanding and Structuring:

Reads and indexes grower contracts, FOB/CIF purchase agreements, storage leases, and credit annexes — extracting key terms such as delivery obligations, quality specs, moisture tolerances, and credit thresholds.

Rapid Information Retrieval:

Allows users to query the system naturally:

- “What’s the minimum protein specification in our Q4 ADM contract?”

- “Which corn contracts have open delivery obligations this month?”

Continuous Compliance Monitoring:

- The agent monitors live trading and logistics activity against contractual terms.

- Detects off-spec deliveries or volumes outside agreed tolerances.

- Flags sales executed without valid counterparty credit approval.

- Warns when shipments deviate from contractual origin or destination clauses.

Real-Time Alerts and Summaries:

Provides automated insights — such as expiring contracts, pending amendments, or exposure concentration by buyer region — helping desks act before issues escalate.

How It Saves Time and Reduces Operational Risk

Streamlined Access to Key Terms

Contracts in ag trading often exist across email threads, shared drives, or scanned PDFs. Analysts may spend hours locating delivery terms or quality clauses.

The Contract Agent indexes every document and provides instant answers — cutting retrieval time from hours to seconds.

Live Oversight of Trading Activity

By integrating with CTRM/ETRM systems (like Allegro, AspectCTRM, or Eka), the Contract Agent continuously cross-references actual trades and nominations with contract constraints.

If a trader exceeds the contracted volume or sells from an unapproved origin, the system flags it instantly — enabling real-time guardrails for compliance and credit teams.

Credit and Exposure Awareness

For ags, counterparty exposure is often seasonal and heavily influenced by delivery windows and storage costs. The Contract Agent helps credit teams monitor limits dynamically, alerting when:

- Credit exposure breaches predefined limits.

- Counterparty ratings change.

- Physical positions accumulate beyond hedged coverage.

Reduced Back-Office Workload

Settlement teams benefit as the agent auto-reconciles invoice details with contract terms — ensuring that moisture discounts, storage fees, or basis adjustments align with agreed conditions.

This reduces disputes and accelerates settlement cycles.

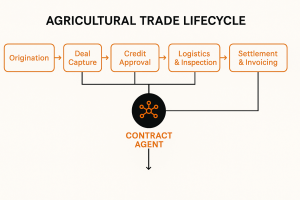

The Agricultural Trade Lifecycle

Understanding where the Contract Agent fits begins with the trade lifecycle. Agricultural commodities follow a structured sequence of events from origination to settlement — each stage generating critical data points that the agent can monitor or enhance.

|

Stage |

Description | Where the Contract Agent Adds Value |

|---|---|---|

| 1. Origination | Contracts negotiated with producers or cooperatives | Extracts and stores key contract fields (crop type, delivery window, quality specs) |

| 2. Deal Capture | Trades entered in CTRM system | Validates entry against authorized contract parameters |

| 3. Credit Approval | Counterparty credit reviewed | Monitors credit exposure and margin calls |

| 4. Logistics & Delivery | Transport, storage, and shipment scheduled | Ensures compliance with contractual origin/destination clauses |

| 5. Quality & Inspection | Grain quality tested and recorded | Flags deviations from agreed spec tolerances |

| 6. Settlement & Invoicing | Payment calculated and processed | Cross-checks invoice details with contract formulas |

| 7. Post-Trade Review | Reports, audits, and renewals | Identifies expiring contracts or recurring issues |

Technical Framework of the Contract Agent

A production-ready Contract Agent typically consists of:

- Document Ingestion Layer: OCR and embedding pipeline that reads scanned contracts and extracts key data.

- Semantic Index or Vector Database: Organizes data by counterparty, crop, delivery window, and clause.

- Integration Connectors: API connections to CTRM, ERP, and risk systems.

- Reasoning Layer: Large Language Models (LLMs) trained on agricultural terminology and contract logic.

- Alert Engine: Business-rule and AI-based triggers for out-of-bounds activity or approaching expirations.

Example Use Case: Detecting Out-of-Bounds Trading

Imagine a trader executes a 15,000 MT soybean sale under a contract that caps deliveries at 10,000 MT for Q4.

The Contract Agent instantly:

- Identifies the overage.

- Cross-references the counterparty’s credit threshold.

- Sends a risk notification to the credit and contracts desk with supporting contract excerpts.

This automation prevents costly non-compliance, overexposure, or reputational damage.

Conclusion

Agricultural markets demand agility, but they also demand control. The Contract Agent provides both — a tireless digital assistant that transforms how contract, credit, and compliance teams interact with the backbone of trading: the deal itself.

By turning static documents into living intelligence systems, the Contract Agent helps organizations prevent errors, enforce limits, and free human analysts to focus on negotiation, risk strategy, and relationship management.

In the coming years, as AI Agents become embedded across CTRM, logistics, and risk platforms, those who harness them early will set the new operational benchmark for speed, compliance, and foresight in ag commodities.